California State Tax Withholding Form 2024 Instructions

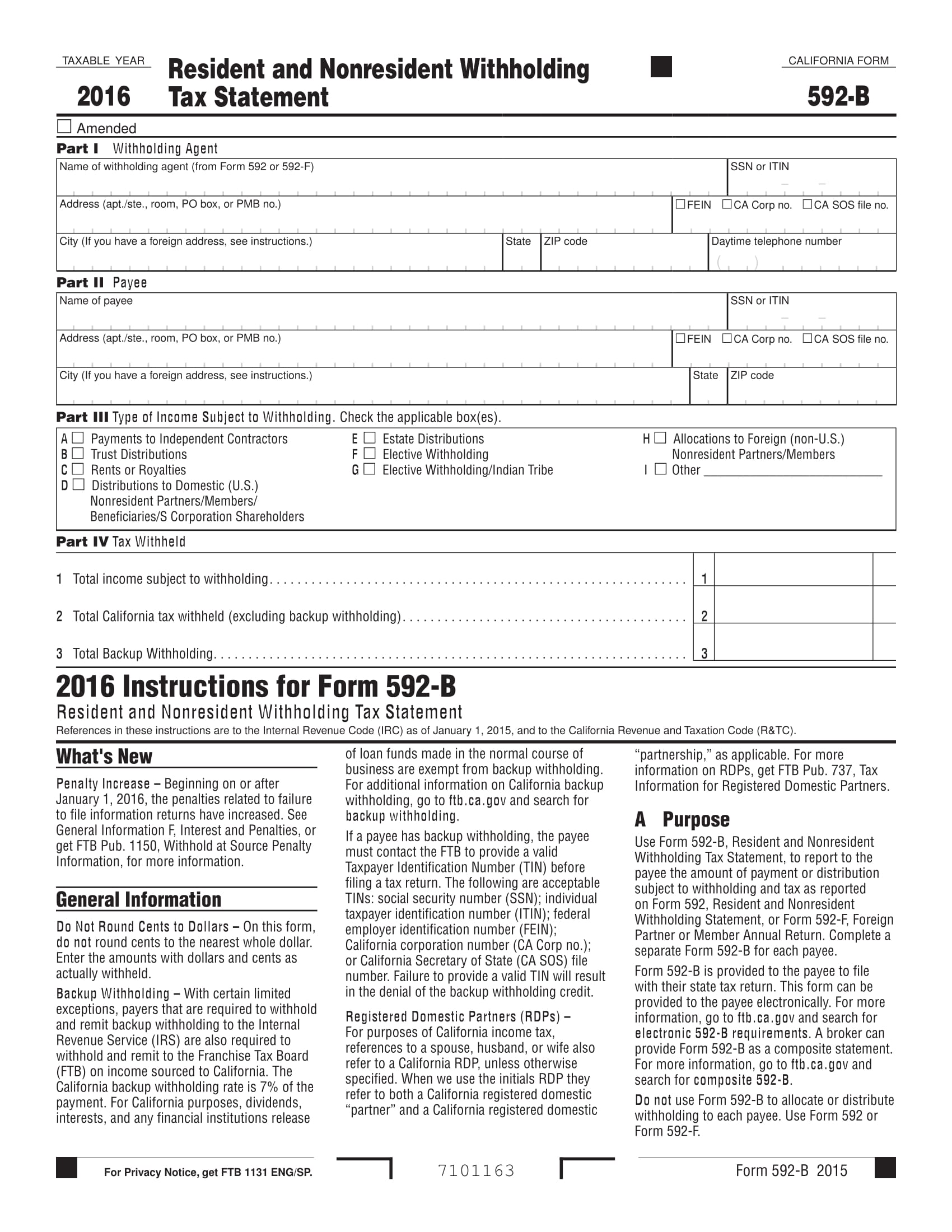

California State Tax Withholding Form 2024 Instructions. The income tax withholdings formula for the state of california includes the following changes: Citizens, green card holders, resident aliens and nonresident aliens) can use the stanford axess website to securely declare or update their tax.

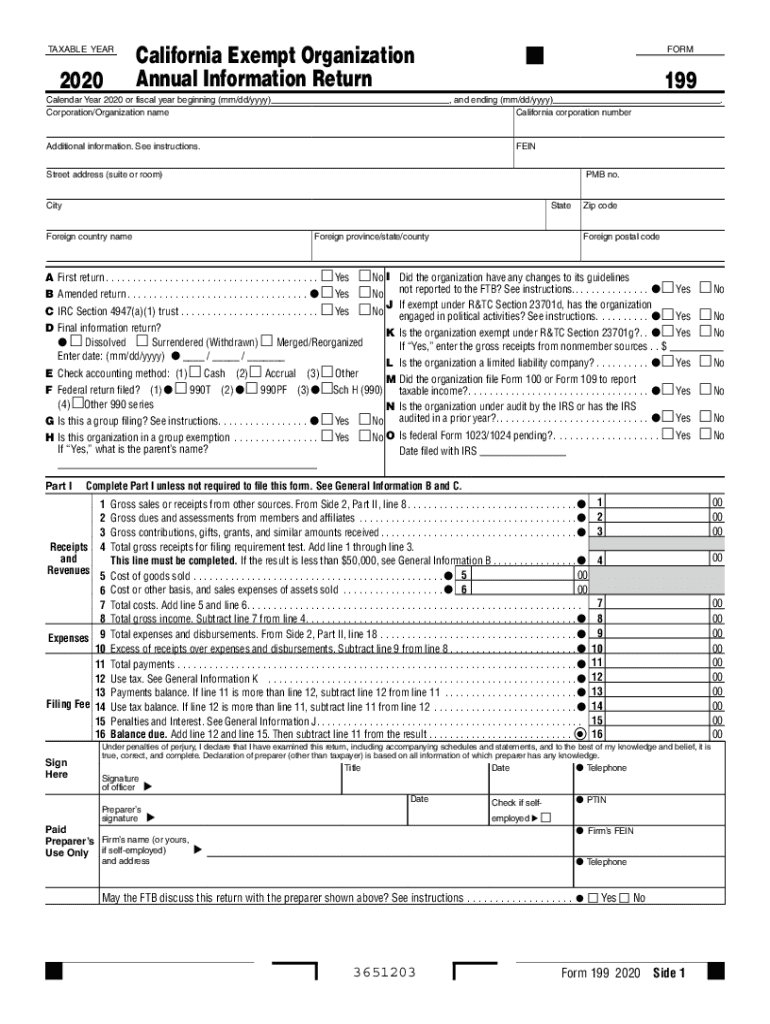

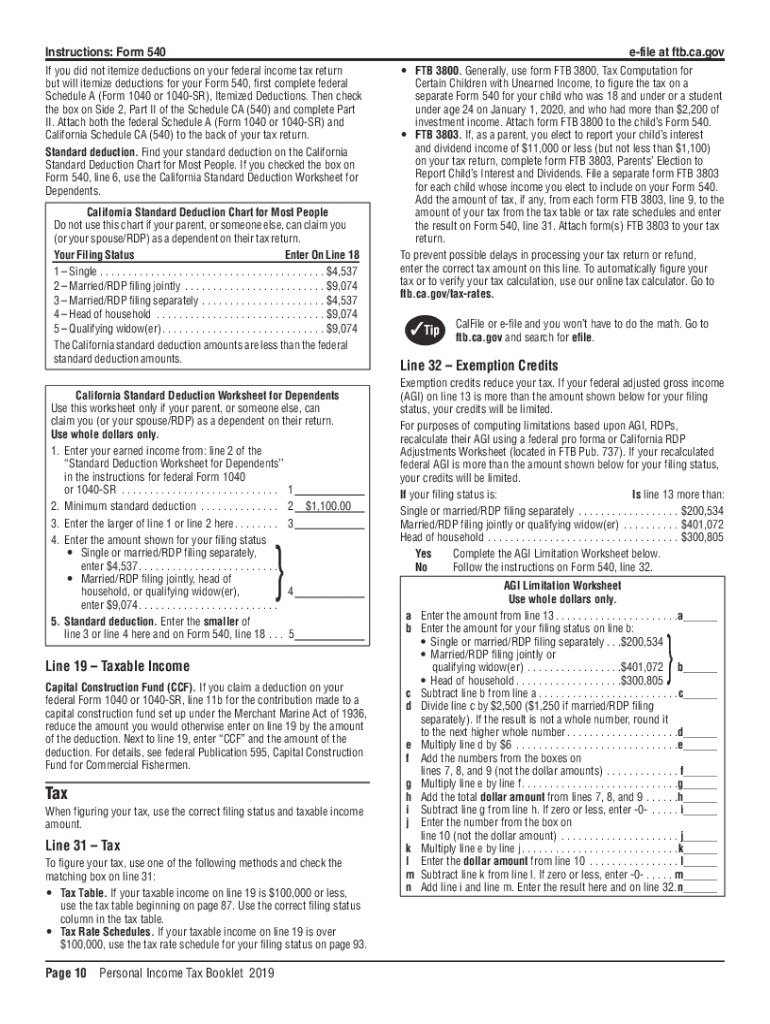

The tax forms below are for california state tax return calculations. The california franchise tax board jan.

California State Tax Withholding Form 2024 Instructions Images References :

Source: noreanwdaphne.pages.dev

Source: noreanwdaphne.pages.dev

2024 Ca State Withholding Form Gladi Kaitlyn, Free tool to calculate your hourly and salary income after federal, state and local taxes in california.

Source: shirleewmeg.pages.dev

Source: shirleewmeg.pages.dev

2024 Ca Tax Form Darya Raychel, The california franchise tax board jan.

Source: jilliewdarda.pages.dev

Source: jilliewdarda.pages.dev

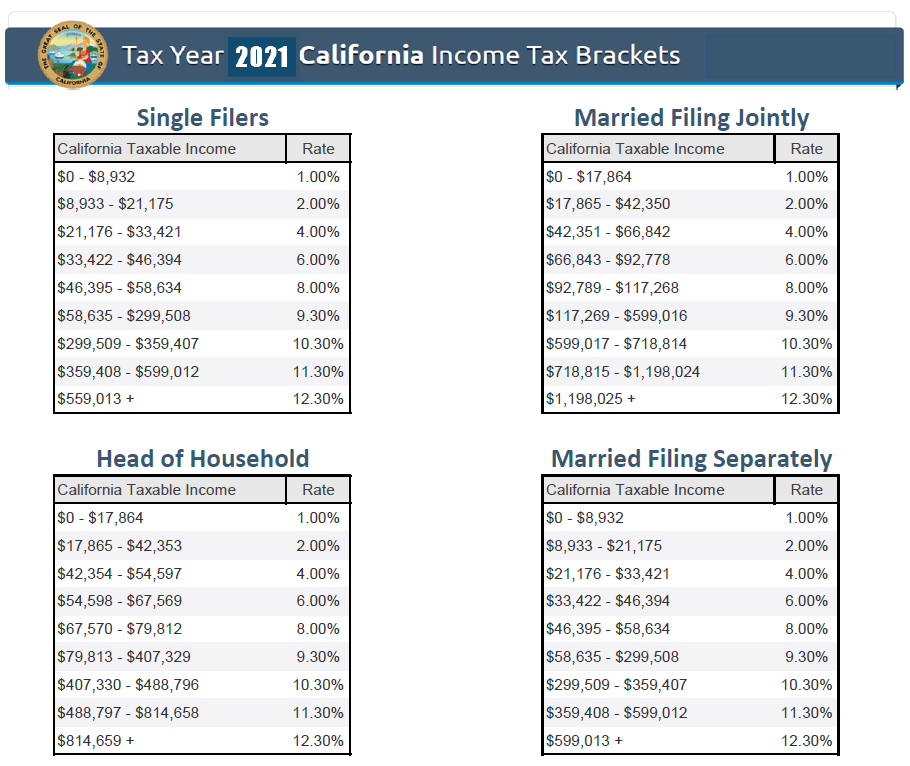

Tax Brackets 2024 California State Aryn Marcie, Citizens, green card holders, resident aliens and nonresident aliens) can use the stanford axess website to securely declare or update their tax.

Source: www.withholdingform.com

Source: www.withholdingform.com

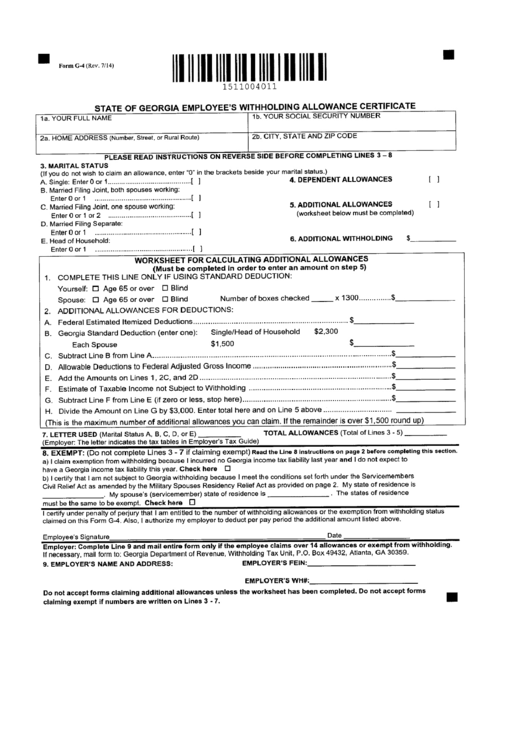

Form De 4 California Employee Withholding, Current year tax forms [sales] california.

Source: gigiymaurizia.pages.dev

Source: gigiymaurizia.pages.dev

California State Tax Withholding Form 2024 Instructions Codie Kariotta, Department of tax and fee administration (cdtfa) current year tax forms [sales].

Source: www.withholdingform.com

Source: www.withholdingform.com

California Employee Withholding Tax Form 2022, The form helps your employer determine.

Source: www.withholdingform.com

Source: www.withholdingform.com

California Nonresident Withholding Tax Form, The low income exemption amount for single and married with 0 or 1.

Source: www.dochub.com

Source: www.dochub.com

California state tax form 2024 Fill out & sign online DocHub, * how often is the employee paid?

Source: leaqsimona.pages.dev

Source: leaqsimona.pages.dev

New California Tax Laws 2024 Darla Harlene, Compare different state withholding forms by using our chart.

Source: www.efile.com

Source: www.efile.com

W4 Form Instructions. Tax Withholding Form., Each form will automatically calculate the relevant tax deductions and amount based on the 2024.